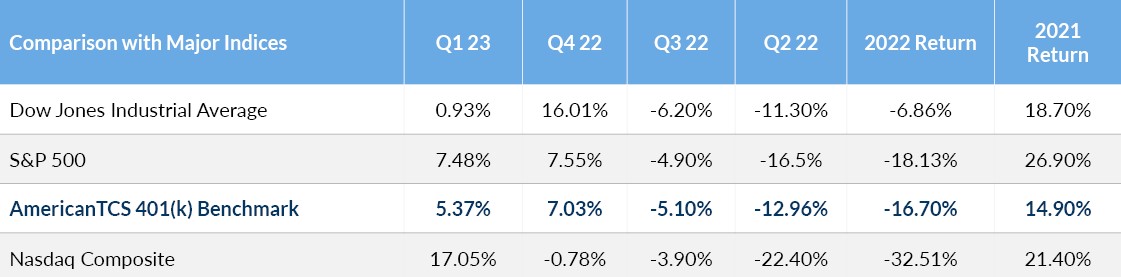

The AmericanTCS 401(k) benchmark generated a return of 5.37% in the first quarter of 2023. Although it trailed the Nasdaq and the S&P 500, the AmericanTCS 401(k) benchmark greatly outperformed the Dow Jones Industrial average. This solid performance is a testament to the effectiveness of a well-diversified retirement savings plan and highlights the potential for 401(k) plans to provide a reliable avenue for retirement savings. This is good news for 401(k) participants as they work toward their long-term financial goals. Although the hypothetical 401(k) investor suffered a 16.7% decline in 2022, after declines in the first three quarters, the AmericanTCS 401(k) benchmark rallied back in the fourth quarter with a 7.03% return.

When we zoom out and look at a hypothetical 401(k) participant over a period of five years, the numbers look much better. During three of the last five years, the AmericanTCS 401(k) Benchmark has generated annual returns greater than 14%, with 2018 posting a -6% return, and 2022 with a -16.70% return. As a final note of success for the hypothetical 401(k) investor, only Dow Jones outperformed the AmericanTCS 401(k) Benchmark when comparing the major indices during a rollercoaster of a year in 2022. This is why experts always recommend 401(k) participants to “stay the course” even during the most turbulent of markets.

About the AmericanTCS 401(k) Benchmark

AmericanTCS is a leading financial services organization that provides a wide array of brokerage, advisory, and trust services to a diverse national client base of financial advisors and institutions, asset managers, and benefits administrators through its various affiliated companies. Because we provide these services, AmericanTCS has plan investment data on over 100,000 401(k) plans representing approximately $125 billion in assets. In response to requests from our institutional clients, we have created the AmericanTCS Composite Benchmark. Using data from plans serviced by AmericanTCS with assets of at least $100,000 at the beginning and ending of the month, the AmericanTCS 401(k) Composite Benchmark is designed to reflect the portfolio performance across 401(k) plans serviced, in any capacity, by AmericanTCS. See the “Methodology” section of this report for details on how the composite benchmark is calculated.